Kastams Import Sst

O SST return has to be submitted not later than the last day. Lampiran C 4 P iii Packaging materials.

Appointment of person acting on behalf by the registered manufacturer of petroleum product to importpurchase raw materials components and packaging materials exempted from the payment of sales tax.

Kastams import sst. Taxable person is any person who belongs in Malaysia and is prescribed to be a taxable person. The SST it is mainly an import tax. Import formalities GB Customs declarant Scan of FR customs formalities and pairing synopsis Agents ferry company Tunnel Embarkation Ferry Company Tunnel Travel with the selected consignment to an IBF BCP 11 2 Disembarkation Ferry company of customs export FR 12 Creation of the GMR customs clearance and ICS Road carrier.

Sales tax is imposed on taxable goods manufactured in Malaysia by any registered manufacturer at the time the goods are sold disposed of other than by. Companies all over the world use ImportKey to analyze suppliers buyers and competitors. Duties mentioned on this page are not final.

Imported Taxable Servicemeans any Taxable Service acquired by any person in Malaysia from any person who is outside Malaysia defined under Section 2 of Service tax Act 2018. Royal Malaysia Customs Department Sales Service Tax Division Putrajaya. Complete Your CITB Approved SSSTS Course With Our Team Here At CST Training.

Digital Service By Foreign Service Provider FSP Domestic Flight. However at the same time not all products are necessary to be taxed. The amount of customs duty paid or to be paid.

Sales tax administered in Malaysia is a single stage tax imposed on the finished goods manufactured in Malaysia and goods imported into Malaysia. Please check latest customs notifications and consult a CHA for final duties. Lampiran C 4 P i Raw materials.

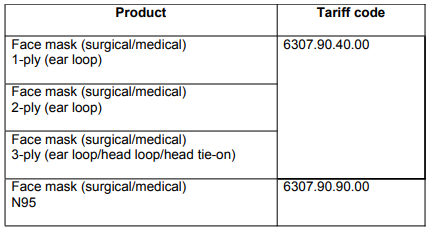

HS Code Item Description. The Sales and Services Tax SST has been implemented in Malaysia. Broking And Underwriting Services.

Sales tax a single-stage tax imposed on taxable goods manufactured locally and sold by a registered manufacturer and on taxable goods imported into Malaysia. Find more detailed instructions about completing a supplementary import declaration in the import declaration completion guide and the customs declaration completion requirements for. Consultancy Training Or Coaching Services.

16-07-2021 Anda perlu menambah customsgovmy kepada emel pegawai bagi tujuan penghantaran emel. Summary on how to apply Exemption for all schedules under Sales Tax Persons Exempted from Payment Of Tax 2018. SST - Guide on Manufacturing Import Export.

1 JALAN PERIGI NENAS 71 KS II TAMAN PERINDUSTRIAN PULAU INDAH. Importing goods covered by a tariff-rate quota Some products are covered by a tariff-rate quota TRQ. This website is developed to enable the public to access information related to the Royal Malaysian Customs Department includes corporate information organization and Customs related matters such as Sales and Service Tax SST.

That means it stops immediately after payment is. -- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA. IMPORT EXPORT Published by.

Service tax a consumption tax levied and charged on any taxable services. January 03 2019 Sales Services Tax. And it takes place only once along the cycle from provider to consumer.

JABATAN KASTAM DIRAJA MALAYSIA SELANGOR NO. Taxable service is any service which prescribed to be a taxable service. Please make your selection.

The SST replaces the existing Goods and Services Tax GST and affects all domestic and import shipments. Trying to get tariff data. 16-07-2021 Anda perlu menambah customsgovmy kepada emel pegawai bagi tujuan penghantaran emel.

Service tax that is a tax charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business. A What is Service Tax. Information of Local Purchase.

Sales tax is only applicable to taxable goods that are manufactured or imported into Malaysia. R - X C --9. Pengarah jusa c.

2 How to apply Exemption under Schedule A. JABATAN KASTAM DIRAJA MALAYSIA SELANGOR NO. With effect from 1st January 2019 service tax will be imposed on the imported taxation servicesinto Malaysia Section 7 of Service tax Act 2018 amended under Finance Act 2018.

Direktori jkdm pulau pinang nama jawatan gred. Lampiran C 4 P ii Components. 04-390 2994 abdul halim bin ramli.

Ad Complete Your SSSTS Course In 2 Days With Our Specialist Team Here At CST Training. Implemented since September 2018 Sales and Service Tax SST has replaced Goods and Services Tax GST in MalaysiaThe SST consists of 2 elements. See products suppliers and buyers related to SST INDUSTRIES PVT LTD.

SALES TAX 2018 GUIDE ON. Common product terms under hs code 73181500 are stainless steel steel fasteners fasteners hex alloy steel w washer. Exported manufactured goods will be excluded from the sales tax act.

A service tax that is charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business and a single stage sales tax levied on imported. If theres a TRQ for your product you can apply to import a limited amount at a zero or. The sales tax rate is at 510 or on a specific rate or exempt.

The amount of excise duty paid or to be paid. ImportKey features trade and import data on over companies world wide with records updated daily and going back to 2008. Credit Card Charge Card.

Deemed import subject to sales tax - Tofrom DA to DA - no sales tax - Tofrom DA to SA - no sales tax. The SST has two elements. 04-382 2111 faks.

DATO SRI ABDUL LATIF BIN ABDUL KADIR Director General Of Customs Royal Malaysian Customs. 1 JALAN PERIGI NENAS 71 KS II TAMAN PERINDUSTRIAN PULAU INDAH.

Impact Of Mco On Customs And Sst Matters Lexology

Komentar

Posting Komentar