Kastam Malaysia Export

Source From Malaysia Through e-Commerce. Start Selling to New Audiences in International Markets Today and Grow Your Business.

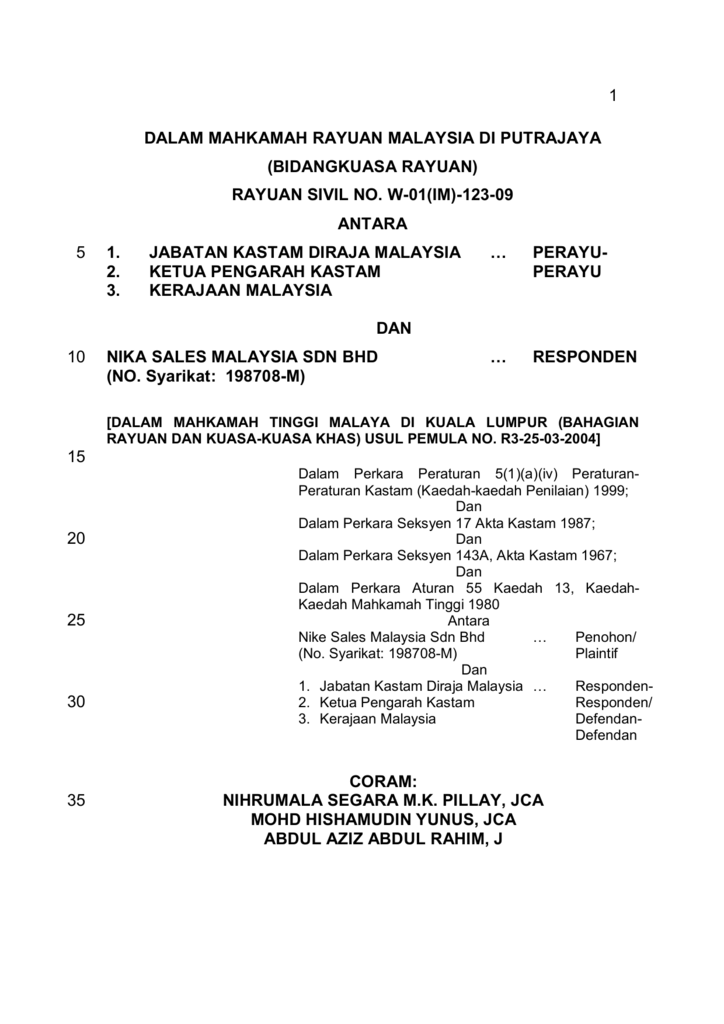

Rayuan Sivil No W 01 Im 123 09 Antara 1 Jabatan Kastam Dir

87 thla sangkat teuk thlakhan export pergudangan.

Kastam malaysia export. Akta Kastam 1967 Akta 235 Menteri membuat perintah yang berikut. About MATRADE Find out how we can assist you. Malaysia Export Exhibition Centre MEEC Exclusive from Malaysia.

Federal reserve foreign exchange rates apec tariff rates north america free trade agreement nafta standard industrial classification sic search tropical timber. 2 Perintah ini mula berkuat kuasa pada 1 April 2017. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline.

Rattan from Peninsula of Malaysia. Live animals from bovine species. Sebelum sesuatu aktiviti pengeksportan dilaksanakan pengeksport atau ejennya hendaklah membuat semakan sama ada barang yang hendak dieksport tersebut merupakan suatu kategori barang yang dilarang atau disekat pengeksportannya dengan merujuk kepada Perintah Kastam Larangan Mengenai Eksport 2017.

These countries have eliminated import duties on 99 per cent of products in the Inclusion List and AFTA is almost completely realised among the ASEAN-6. And held that goods exported out of Malaysia constitute zero-rated supplies notwithstanding that the exporter was not named in export declaration forms K2 Forms. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03-8882 21002300 Ibu Pejabat ccccustomsgovmy.

Garis Panduan Pemberian Penerimaan Hadiah JKDM. Malaysia Export Exhibition Centre MEEC Exclusive from Malaysia. On average today ASEAN 6 has 9920 of tariff lines in the.

Di bawah peruntukkan Seksyen 92A Akta Kastam 1967 takrif eksport semula yang dipakai di bawah Seksyen 93 94 dan 99 Akta Kastam 1967 adalah termasuk pergerakan barang-barang ke gudang-gudang berlesen yang dilesenkan di bawah Seksyen 65A Akta Kastam 1967 dan kedai bebas cukai yang dilesenkan di bawah Seksyen 65D Akta yang sama. The following are some of the goods which require an export licencepermit from relevant authorities. Harmonized system codes schedule b harmonized commodity description.

In the case of goods imported by road such declaration shall be made on arrival of such goods at. Untuk info lebih lanjut sila layari. Pelan Antirasuah Organisasi JKDM.

Any animal or bird other than a domestic animal or domestic fowl whether alive or dead or any part thereof. Trade. Exchange Rate IMPORT -- Select A Date -- Import - 09082021 Import - 16082021 Import - 23082021 Import - 30082021 Import - 06092021 Import - 13092021 Import - 20092021 Import - 27092021 Import - 04102021 Import - 11102021 Import - 18102021 Export - 09082021 Export - 16082021 Export - 23082021 Export - 30082021.

Ad Expand Your Audience And Companys Reach And Drive Tangible Growth Through Exporting. Jabatan Kastam Diraja Malaysia Tulisan Jawi. JSB v Ketua Pengarah Kastam.

JKDM berfungsi sebagai pemungut cukai tidak langsung utama negara memberi fasilitasi kepada perdagangan dan menguatkuasa undang-undang. Please make your selection. A Conditions not stated under law The language of s 171b of the Goods and Services Tax Act 2014 GST Act is clear and unambiguous.

1 Pengimportan ke dalam Malaysia barang-barang yang dinyatakan dalam ruang 2 Jadual Pertama yang berasal atau dibuat. 1 Perintah ini bolehlah dinamakan Perintah Kastam Larangan Mengenai Import 2017. JKDM ialah sebuah badan jabatan kerajaan di bawah Kementerian Kewangan Malaysia.

3 form are as. Nama dan permulaan kuat kuasa 1. What is Excise Duty.

The court made among others the following key points. Start Selling to New Audiences in International Markets Today and Grow Your Business. جابتن كستم دراج مليسيا.

Kuala lumpur malaysia 001953087488 09102021 1027 wisma kastampelabuhan kla b10 e0401021 page 1 he xing wang imp exp coltd page 12 copies1 38 st. The current browser does not support Web pages that contain the IFRAME element. Jadual Pertama Larangan mutlak 2.

Perkhidmatan ini diberikan secara percuma. Products. Akademi Kastam Diraja Malaysia AKMAL Information Technology Division.

-- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA. Export Acceleration Mission on Professional Services to Jeddah. Effective 1 January 2010 Malaysia with five other ASEAN Member States which are Brunei Darussalam Indonesia the Philippines Singapore and Thailand is a complete free trade area.

Imported goods can only be released from customs control after the duty andor tax paid in full except as otherwise allowed by the Director General. Ejen Kastam Pengimport-pengimport dan pengeksport-pengeksport dibenarkan melantik mana-mana agen untuk bertindak bagi pihak mereka dangan terlebih dahulu mendapat kelulusan daripada Jabatan Kastam atau lebih tepat lagi Ketua Pengarah Kastam bagi kerja-kerja untuk pelepasan daripada pemeriksaan kastamPermohonan bagi agen-agen yang sah hendaklah dikemukakan kepada. Trying to get tariff data.

Upon arrival in Malaysia all goods need to be declared within one month from the date of import by the owner or his agent in the prescribed form. Down town iv phum teuk bp pengarah kastam code. Perintah kastam larangan mengenai eksport 2017 1.

Meat of bovine animals. Get connected and find other businesses in the same industry. Pengurusan tertinggi JKDM diterajui oleh Ketua Pengarah Kastam Turus III.

3 form is required for the following circumstances aTransportation of goods between territories bTransportation of goods within the same territory cTransportation via air and sea only The use of Customs No. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. Use for export of goods from the country K3 Transportation of Goods Between Peninsular Malaysia Sabah Sarawak and transportation within the same territory Customs No.

Sales tax administered in Malaysia is a single stage tax imposed on the finished goods manufactured in Malaysia and goods imported into Malaysia. Sales tax is imposed on taxable goods manufactured in Malaysia by any registered manufacturer at the time the goods are sold disposed of other than by sales. RMCDs Strategic Plan.

Board of Directors. Kastam Malaysia Hs Code Applying the right hs code to your import or export is important when it comes to ensuring speeding up the shipping process. Untuk pengeksport atau pengimport yang mengetahui Kod HS AHTN untuk produk anda anda boleh merujuk pada petugas di Ketua Jabatan Kastam Diraja Malaysia atau pejabat cawangan untuk mendapatkan bantuan.

HS Code Item Description. Ad Expand Your Audience And Companys Reach And Drive Tangible Growth Through Exporting. Learn from established export businesses.

Atiga National Guideline 8 Jan 2015 13 Miti 15 1 2015

Komentar

Posting Komentar